The Economic Genius of Recep Tayyip Erdogan

Erdogan turned Türkiye into an attractive offshoring destination. Companies are at risk from technology appropriation, currency instability and supply chain disruptions due to geopolitical conflict.

Executive Summary

We accept that President Erdogan is smarter than we are, and that he understands the impact of negative real interest rates on inflation. We assume, therefore, that he had political objectives in pursuing this unconventional economic policy.

We believe that Erdogan was trying to turn Türkiye into an exports powerhouse, in a bid to copy the Chinese model of low cost labour and high tech capabilities. We believe he succeeded, while managing to raise the living standards of the average Turk even as the Turkish lira depreciated.

This policy allowed Erdogan to destabilise the middle class and prevent it from organising against him, reward the poorer and working classes with benefits, and keep the rich on side, while succeeding in boosting exports as a share of the economy and expanding manufacturing.

Erdogan’s foreign policy flexibility means that he can continue to find creative ways to finance the current account deficit, preventing a full-fledged banking crisis. Erdogan, however, benefits from a permanent climate of crisis, and that will not change, forcing companies to spend on sophisticated currency hedging strategies.

Türkiye has become a prime destination for offshoring and nearshoring. It can compete with European exporters more effectively, and draw European investors to locate production there and export to Europe.

Türkiye will likely work on appropriating technology from Western firms, as it continues to seek to develop its industrial potential.

In the 20 year outlook, Türkiye is on a collision course with Iran and with the European right. That said, Türkiye will do its best to avoid colliding with both simultaneously.

As such, in the 20-year outlook, Turkish supply chains connected to Asia are going to be highly vulnerable to Iranian military aggression.

Analysis

Erdogan is smarter than we are

Many analysts are hobbled by the assumption that they are smarter than the President of Türkiye. The one who tamed and broke the notorious Turkish deep state, restored Türkiye to Islamism in the face of fierce opposition from a well-entrenched secular elite, and is seen as a worthy adversary by the cunning and ruthless leaders of Iran, Russia, India, China and the United States.

We at Modad Geopolitics accept that the President of Türkiye is much smarter than we are. We accept that President Recep Tayyip Erdogan is economically literate, that he understands the impact of his low interest rate policy on inflation and the current account, and that he chooses to pursue this policy anyway for political motives.

Having cleared our heads of delusions of grandeur, we asked ourselves, what has the President of Türkiye, who showed a remarkable ability to tame inflation and keep international markets happy for the first half of his tenure, been trying to achieve since 2010?

Erdogan vs the market

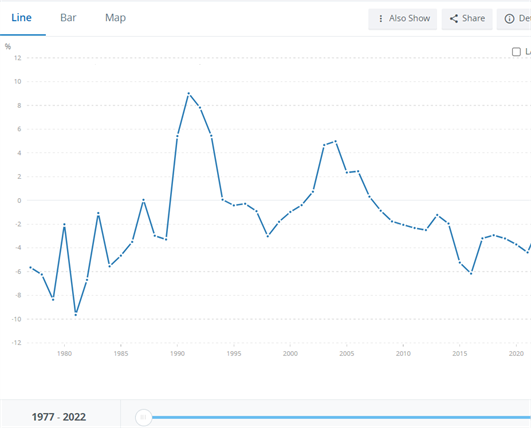

Türkiye has always had a balance of payments problem and an inflation problem. The period between 2001 and 2010, during which then-Prime Minister Erdogan tamed inflation, was the exception, not the rule. When Erdogan first took power, he fixed the longstanding inflation problem. In part, this helped him undermine military interests and the old commercial and industrial elite, through privatisations, reducing public debt and implementing IMF recommendations. Having weakened his rivals economically, he proceeded to move against them politically, with the judiciary being used in the Ergenekon trials to purge the army and parts of the elite that had threatened Erdogan.

Melding foreign and economic policy

Our assessment is that the priority of President Erdogan shifted at some point between 2008 and 2012. The disorder of the Arab Spring, the Syrian Civil War, and the failure of the Muslim Brotherhood to gain power pushed Türkiye to emphasise hard power, and not just soft power. This required greater self-reliance in military industries and in general manufacturing. Our view is that Türkiye prioritised that over other, conventional economic considerations, such as inflation, price stability, the current account or the like. Erdogan was able to shift priorities in this way because he had already broken the back of rival potential power centres. The push to stabilise the currency and inflation had already paid off politically, and now different political priorities required a different economic policy. (Many analysts struggle to understand that political leadership is about more than GDP growth, as I explain here).

This unconventional economic policy was only possible due to Türkiye having a low debt to GDP ratio and reliable foreign partners, such as Qatar, Azerbaijan and others, which were able to pump foreign currency into the Turkish system through swaps and direct investments. Erdogan skilfully merged foreign policy and economic policy, supporting small entities with large energy reserves – Iraq’s Barazani-led Kurdistan Regional Government, Qatar, Azerbaijan and the Tripoli-government of Libya – in exchange for their economic support. Furthermore, President Erdogan showed that he could adapt his foreign policy positions to shore up his current account, as demonstrated by his reconciliations with Saudi Arabia and the UAE, which netted him fresh billions in aid without cutting off his relations with other allies like Qatar.

Political economy:

Not only did this policy succeed, as evidenced by the rise in exports as a percentage of GDP, rising Turkish GDP per capita, and the increased capability of Turkish industries to develop high quality weapons systems, but it also served Erdogan politically. Erdogan was able to regulate the banking sector to force it to lend to friends of the regime to conduct big ticket investments. He was also able to threaten the rich classes, as the persistent inflation allowed him to demonise financiers and financial interests – this meant that he could easily turn the judicial system against his rivals, with large public support. Such threats ensured that the business elites remained in line. In return, Erdogan made a point of travelling the world with Turkish business delegations, helping them enter new markets. He supported their interests, and they supported his policy objectives. The more Turkish commercial interests expanded abroad, the more Turkish politicians – led by Erdogan – had influence. It was a self-reinforcing cycle. It also helped that countries like Kuwait and Qatar – terrified of the role of Saudi Arabia and Iran – decided to back Erdogan’s objectives, with Qatar playing an especially important role through its support for the Muslim Brotherhood.

Furthermore, high inflation meant that the middle class was destabilised, and therefore unable to organise a repeat of the Gezi Park protests that almost destabilised Erdogan’s rule. For their part, the poor could be appeased with subsidies and benefits. It also helped that, despite persistently high inflation, Türkiye’s GDP per capita kept increasing, reflecting the success of Erdogan’s complex balancing act. These factors helped consolidate Erdogan’s rule and allowed him to consistently win elections.

A sharp turn

Having pushed through his favoured policy, Erdogan appears to have shifted priorities. Erdogan has permitted the central bank to raise interest rates to 45%. The IMF Article IV report of 2023 predicted that inflation in Türkiye by the end of 2024 would be 46%. Therefore, technically, Erdogan has not abandoned his official position of zero interest rates. Rather, he has permitted the freezing of interest rates at around the predicted inflation rate, resulting in zero real interest rates. In doing so, Erdogan can be ideologically consistent while appeasing the market. This again reflects the extent of flexibility that has characterised his reign. The question is why did Erdogan change his mind and allow interest rates to rise? Perhaps because the the policy achieved its objectives, and because global instability makes Türkiye a more attractive investment destination without needing to keep pressuring the current account?

Long term considerations:

Türkiye is not energy independent – it relies on large scale energy imports from Iraq, Iran and Russia. The Iraqi route was closed due to international court action by the Iraqi state, which stopped the Kurdistan Regional Government from exporting oil to Türkiye while bypassing Baghdad. This is a major pressure point that Iran has over Türkiye. It is worth recalling that Türkiye is also competing with Iran over northern Syria, which is also energy rich. For Türkiye, control over northern Iraq and Syria would give it energy independence and help it secure its economy and therefore global influence. Türkiye is working on developing alternative sources of energy, including the offshore Sakarya gas field, projected to supply 30% of its needs by 2028, and some 70GW of offshore wind, of which 10 GW have been completed. The competition over energy is going to be critical, and Iran is Türkiye’s main rival.

Furthermore, Türkiye is expanding its influence in Somalia – across from Iran’s allies in the Ansar Allah Movement in Yemen. Moreover, Türkiye has a military presence across from Iran in Qatar, and is deepening its defence cooperation with Kuwait and Oman. All three Gulf Arab countries view Iran as a threat, and are seeking Turkish protection. Given that both Iran and Türkiye are revisionist powers seeking to lead the Muslim world, competition between them is inevitable. The key question is how far the competition goes. There is a real risk of a direct war between them in the next 20 years.

Last, Türkiye conceives of itself as the leader of the Muslim world, and as the successor state of the Ottoman Empire. It also views Europe as decadent and weak, having allowed itself to be penetrated by Islamists and with collapsing demographics. This will drive Türkiye, in the next 20 years, to prioritise military technology with the aim of ensuring its role as the protector of European Muslims, and as the agent of the Islamisation of Europe.

Commercial Implications:

Erdogan demonstrates that combining foreign policy, monetary policy and industrial policy in a creative manner can have a transformative economic impact. That Erdogan did so while navigating the complex electoral politics of Türkiye is a testament to his personal genius - the Asian Tigers were only able to do so while benefiting from one-party rule or military dictatorships.

Türkiye will continue to face difficulties with its balance of payments for the foreseeable future, but not a full blown crisis, as Erdogan is able to shift policy to prevent that.

Companies in Türkiye will likely require a sophisticated strategy to hedge against currency risks, potentially favouring larger companies at the expense of smaller ones.

Erdogan may well decide that higher inflation in exchange for faster growth and more industrialisation and exports is an acceptable trade off. As such, even though it appears that Türkiye has decided to fix its inflation problem, this should not be treated as definitive. Erdogan remains the only decision maker who counts. Moreover, he is adept at benefiting from a climate of crisis, which keeps his options open, keeps his opponents off balance, and keeps all potential rivals and power centres dependent on him.

Türkiye will continue to prioritise industrial production. It very likely views a key commercial opportunity in the drive of European and American companies to safe-shore production away from Asia. This permits Türkiye to pursue a more conventional economic policy while continued to develop industrially.

Türkiye, like China, will prioritise the acquisition of intellectual property from foreign companies, using legal and illegal means, with a view of being able to develop as many industries independently of the West as possible.